☑ What company repossessed my car

- By Ines

- 28 Mar, 2021

What company repossessed my car. Unfortunately, having your car repossessed isn’t the end of the road on your car loan. Breaching the peace usually means using or threatening to use physical force against you to take the car back. When a car is repossessed by a lender, liability for the car and damages made to it transfers to the lender as well. If you stop making payments, the lender may repossess your car.

Pin On Finance Guides From pinterest.com

Pin On Finance Guides From pinterest.com

Car auctions is an easy way and most of the time cheaper way to get behind the wheel of a great second hand car. A repossessed vehicle may be sold privately or at an auction. In some cases, lenders can disable your car by remote control so you can’t drive it until you clear things up. The repo man takes over the car when you are least aware. Many americans owe more on their car than it is worth and their loan is “underwater.” here’s what you need to know about vehicle repossession and how chapter 7 bankruptcy can offer some debt relief. Lenders might send a driver to collect the car, or they may take it away with a tow truck.

Vehicle repossession companies regularly go through public parking lots to scan license plates and search for cars that they can take.

Put the request in writing and list everything you left in the car. If lien holder will not repo my car, what options do i have? Once the repo process has begun, the repo man can take your vehicle from your driveway, your workplace parking lot, or even while you’re out shopping. Request all documents related to the repossession for additional information. Once the vehicle is repossessed, you will owe repossession fees and storage costs in. Each of these entities is authorized by california law to pursue car repossession.

Source: pinterest.com

Source: pinterest.com

Each of these entities is authorized by california law to pursue car repossession. Of course, you must have a certain license authorizing these entities to repossess the vehicle. Here’s what happens if the repo company can’t recover your car. (learn about options to avoid a car repossession in the first place.) how to get items back. Collateral bankruptcy services, llc is a company created to specifically address this problem and make it so that you or your client do not have to face and make illogical, tough, costly decisions like the debtor and his attorney were forced to.

Source: pinterest.com

Source: pinterest.com

This means that if you’re behind on car payments, your car could be repossessed without warning whenever it’s parked in a public space. Thus, if the vehicle is impounded by the government for not having a license, then if the buyer does not get it out of impound immediately, the only way for the finance company to protect its security in the vehicle is to send a repossession agent to the government tow yard, pay off the required amount, then hold the vehicle in its tow yard or. For example, if the car will be sold at a public auction, your state’s laws might require the lender to tell you when and where the auction will happen so you can be there and bid. Many americans owe more on their car than it is worth and their loan is “underwater.” here’s what you need to know about vehicle repossession and how chapter 7 bankruptcy can offer some debt relief. But it can also simply involve repossessing the car from your closed garage.

Source: pinterest.com

Source: pinterest.com

In repossession, a bank or leasing company takes a vehicle away from a borrower who is behind on payments, often without warning. Promptly contact the lender after your vehicle is repossessed and ask that your property be returned. If you don’t reinstate the loan or you live in a state where there is not a right to reinstate, your lender can either keep the vehicle as compensation for your debt or sell it at a private or public sale. A repossessed vehicle may be sold privately or at an auction. If the lender claims they did not take it, call the local police department to determine who repossessed the vehicle.

Source: pinterest.com

Source: pinterest.com

So, if a repossession company damages the car in the course of repossessing it, then the company is legally responsible for the damages. Vehicle repossession companies regularly go through public parking lots to scan license plates and search for cars that they can take. Many americans owe more on their car than it is worth and their loan is “underwater.” here’s what you need to know about vehicle repossession and how chapter 7 bankruptcy can offer some debt relief. However, in some situations, the lender chooses not to repossess the car. When a car is repossessed by a lender, liability for the car and damages made to it transfers to the lender as well.

Source: pinterest.com

Source: pinterest.com

Generally, car repossession occurs after a series of missing or late payments without any communication or agreements with lenders. When a car is repossessed by a lender, liability for the car and damages made to it transfers to the lender as well. If lien holder will not repo my car, what options do i have? If the lender is uncooperative—which is unlikely—consider suing in small claims court. In some cases, lenders can disable your car by remote control so you can’t drive it until you clear things up.

Source: pinterest.com

Source: pinterest.com

When a car is repossessed by a lender, liability for the car and damages made to it transfers to the lender as well. If the lender claims they did not take it, call the local police department to determine who repossessed the vehicle. For example, if the car will be sold at a public auction, your state’s laws might require the lender to tell you when and where the auction will happen so you can be there and bid. But it can also simply involve repossessing the car from your closed garage. Lenders might send a driver to collect the car, or they may take it away with a tow truck.

Source: ar.pinterest.com

Source: ar.pinterest.com

If you receive one of the first two notices, you should act immediately to work out a payment plan with your lender. After your vehicle is repossessed, your lender can either keep it to cover your debt or sell it. In some cases, lenders can disable your car by remote control so you can’t drive it until you clear things up. If lien holder will not repo my car, what options do i have? Hiding your car from the repo company.

Source: autodeal.com.ph

Source: autodeal.com.ph

But it can also simply involve repossessing the car from your closed garage. If you don’t reinstate the loan or you live in a state where there is not a right to reinstate, your lender can either keep the vehicle as compensation for your debt or sell it at a private or public sale. If you stop making payments, the lender may repossess your car. A vehicle may be repossessed by a registered repossession agency or the auto finance company. However, they can�t breach the peace while they do it.

Source: pinterest.com

Source: pinterest.com

If you don’t reinstate the loan or you live in a state where there is not a right to reinstate, your lender can either keep the vehicle as compensation for your debt or sell it at a private or public sale. But it can also simply involve repossessing the car from your closed garage. If you don’t reinstate the loan or you live in a state where there is not a right to reinstate, your lender can either keep the vehicle as compensation for your debt or sell it at a private or public sale. Of course, you must have a certain license authorizing these entities to repossess the vehicle. Our mobile app allows for repossession companies to easily scan license plates or vin numbers to verify if the vehicle is marked for repossession by a lender.

Source: pinterest.com

Source: pinterest.com

Our mobile app allows for repossession companies to easily scan license plates or vin numbers to verify if the vehicle is marked for repossession by a lender. Thus, if the vehicle is impounded by the government for not having a license, then if the buyer does not get it out of impound immediately, the only way for the finance company to protect its security in the vehicle is to send a repossession agent to the government tow yard, pay off the required amount, then hold the vehicle in its tow yard or. If the lender is uncooperative—which is unlikely—consider suing in small claims court. Repo men can seize your car from any open, public space, like the parking lot of your favorite restaurant or grocery store. Of course, you must have a certain license authorizing these entities to repossess the vehicle.

Source: pinterest.com

Source: pinterest.com

This means the lender grants the loan based on collateral (the vehicle) and can repossess that collateral in the event you don�t make your payments. In some states, your lender has to let you know what will happen. Once the repo process has begun, the repo man can take your vehicle from your driveway, your workplace parking lot, or even while you’re out shopping. Typically, recovery companies attempt to find your car for up to 30 days. These laws usually provide for a time period after repossession in which you can get your vehicle back by making up any existing overdue payments and the cost of repossession.

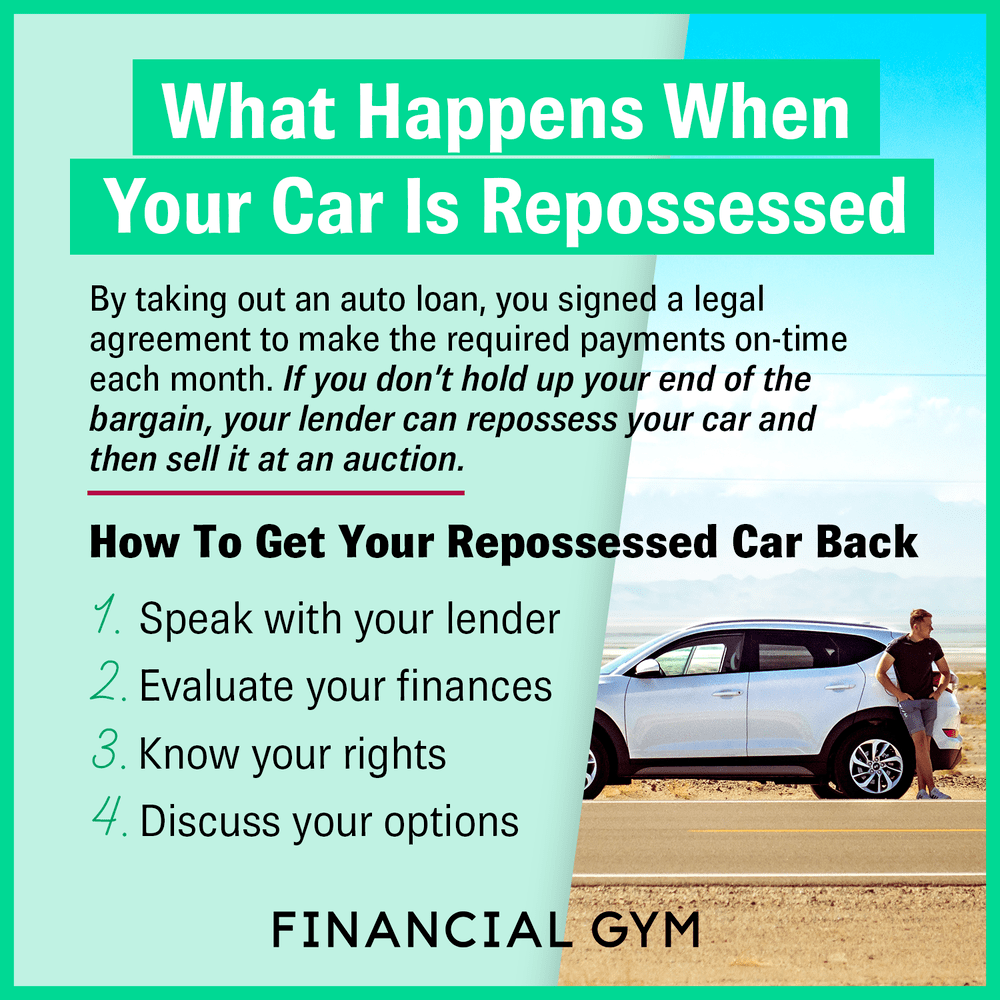

Source: financialgym.com

Source: financialgym.com

Of course, you must have a certain license authorizing these entities to repossess the vehicle. Generally, car repossession occurs after a series of missing or late payments without any communication or agreements with lenders. But it can also simply involve repossessing the car from your closed garage. When a car is repossessed by a lender, liability for the car and damages made to it transfers to the lender as well. Vehicle repossession companies regularly go through public parking lots to scan license plates and search for cars that they can take.

Source: br.pinterest.com

Source: br.pinterest.com

If the lender is uncooperative—which is unlikely—consider suing in small claims court. When a car is repossessed by a lender, liability for the car and damages made to it transfers to the lender as well. Posted on jun 20, 2013. However, in some situations, the lender chooses not to repossess the car. After your vehicle is repossessed, your lender can either keep it to cover your debt or sell it.

Source: pinterest.com

Source: pinterest.com

Unfortunately, having your car repossessed isn’t the end of the road on your car loan. Each of these entities is authorized by california law to pursue car repossession. Hiding your car from the repo company. Breaching the peace usually means using or threatening to use physical force against you to take the car back. A repossessed vehicle may be sold privately or at an auction.

Source: pinterest.com

Source: pinterest.com

If the lender is uncooperative—which is unlikely—consider suing in small claims court. Once the repo process has begun, the repo man can take your vehicle from your driveway, your workplace parking lot, or even while you’re out shopping. If the lender claims they did not take it, call the local police department to determine who repossessed the vehicle. Generally, car repossession occurs after a series of missing or late payments without any communication or agreements with lenders. A vehicle may be repossessed by a registered repossession agency or the auto finance company.

Source: pinterest.com

Source: pinterest.com

But he must do it peacefully even in your presence. These laws usually provide for a time period after repossession in which you can get your vehicle back by making up any existing overdue payments and the cost of repossession. This means the lender grants the loan based on collateral (the vehicle) and can repossess that collateral in the event you don�t make your payments. The creditor can repossess the vehicle once you miss a payment (even single) or haven’t insured your vehicle. Once the repo process has begun, the repo man can take your vehicle from your driveway, your workplace parking lot, or even while you’re out shopping.

Source: pinterest.com

Source: pinterest.com

Posted on jun 20, 2013. A vehicle may be repossessed by a registered repossession agency or the auto finance company. Many americans owe more on their car than it is worth and their loan is “underwater.” here’s what you need to know about vehicle repossession and how chapter 7 bankruptcy can offer some debt relief. Collateral bankruptcy services, llc is a company created to specifically address this problem and make it so that you or your client do not have to face and make illogical, tough, costly decisions like the debtor and his attorney were forced to. Repossession companies also have access to live data feeds from thousands of app users who are scanning vehicles for them and will get updates when and where a user scanned a vehicle that is marked for repossession.

Source: id.pinterest.com

Source: id.pinterest.com

Repo men can seize your car from any open, public space, like the parking lot of your favorite restaurant or grocery store. Vehicle repossession companies regularly go through public parking lots to scan license plates and search for cars that they can take. The creditor can repossess the vehicle once you miss a payment (even single) or haven’t insured your vehicle. Here’s what happens if the repo company can’t recover your car. Once the vehicle is repossessed, you will owe repossession fees and storage costs in.

Source: studentloanhero.com

Source: studentloanhero.com

Collateral bankruptcy services, llc is a company created to specifically address this problem and make it so that you or your client do not have to face and make illogical, tough, costly decisions like the debtor and his attorney were forced to. If lien holder will not repo my car, what options do i have? Thus, if the vehicle is impounded by the government for not having a license, then if the buyer does not get it out of impound immediately, the only way for the finance company to protect its security in the vehicle is to send a repossession agent to the government tow yard, pay off the required amount, then hold the vehicle in its tow yard or. Repossession companies also have access to live data feeds from thousands of app users who are scanning vehicles for them and will get updates when and where a user scanned a vehicle that is marked for repossession. If you receive one of the first two notices, you should act immediately to work out a payment plan with your lender.

Source: carbuyer.co.uk

Source: carbuyer.co.uk

The creditor can repossess the vehicle once you miss a payment (even single) or haven’t insured your vehicle. After your vehicle is repossessed, your lender can either keep it to cover your debt or sell it. Breaching the peace usually means using or threatening to use physical force against you to take the car back. The creditor can repossess the vehicle once you miss a payment (even single) or haven’t insured your vehicle. 2016 hyundai accent 1.6 gl/motion.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what company repossessed my car by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.